Bank bosses came under fire from Wigton councillors about their decision to close one of the town's only remaining branches.

Wigton's Natwest bank, in High Street, will close its doors for good on October 10, along with seven other branches in Cumbria.

The company blamed changes to the way people are banking, especially a shift towards online rather than transactions in branch, as the reason why it was closing a number of sites.

In a statement announcing its closure, NatWest said that since 2011 the number of transactions at the Wigton branch had fallen by 26 per cent.

The news was a hammer blow to many in the town and the surrounding area following the recent closure of the HSBC bank and continuing fears about the rising amount of empty shops in the high street.

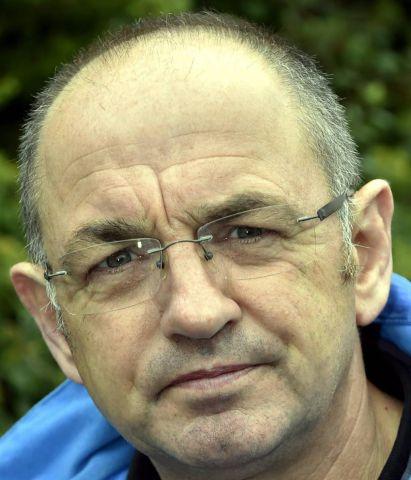

But more details about what will happen to the bank's service in Wigton were revealed at a town council meeting, when NatWest chief Jonathan Rogers, who's been appointed by the company to offer a link between the bank and the community, addressed councillors.

"It's unfortunate that the branch is closing in Wigton but my role will be to retain that community link with Wigton, to keep a presence in the town," he said.

"I'll be establishing links with community groups providing advice on alternative ways to bank, fraud and scam awareness.

"I'm hoping to arrange with the library about opening up a drop-in surgery once the bank closes. Members of the public can then come in for face-face-meetings.

"With things like cheques and cash transactions they will have to be done in the Post Office.

"We are awaiting confirmation about when the mobile bank will come to Wigton."

He added that many of the day-to-day services offered in the branch would be available in the town's Post Office.

Councillor Alan Pitcher questioned how effective the new service will be, especially for elderly people.

He added: "When we set up the bank accounts for Wigton Baths we set them up with Natwest because it was in the town and because it had a night safe. Now there will be none."

Mr Pitcher said that the night safe issue in particular would cause a problem for many local businesses and organisations.

Councillor David Ferriby said: "I don't think you can underestimate the influence all the bank closures are having on small towns like Wigton.

"People come into town to shop and bank."

Mr Rogers told the meeting that he would look into the future of the night safe in Wigton and report back at a later date.

Wigton's last remaining bank is Barclays, which is only open four days per week. There is also a branch of the Cumberland Building Society in town.

NatWest says that customers are “actively” choosing to bank in different ways, with 52 per cent choosing to use its digital banking options.

In addition to the Wigton branch, NatWest is also closing those in Keswick, Cockermouth, Egremont, Ambleside, Millom, Ulverston and Grange-over-Sands.

Nearby Silloth lost its Natwest branch last year but the building is being geared up for a new lease of life.

The Eden Street site, once home to famous singer Kathleen Farrier, was bought by Lancashire-based businessman Alan Maggs who is converting it into a wine bar and an apartment-hotel.

It's due to be completed later this summer.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here